paystubs for the small business employees aid you in tracking the overflow of earnings for the employees but the process of preparing the same isn’t easy. the following is a proven guide when preparing a superb paystub for the small business employees. the paystub documents information for the employees on how their paychecks are determined.

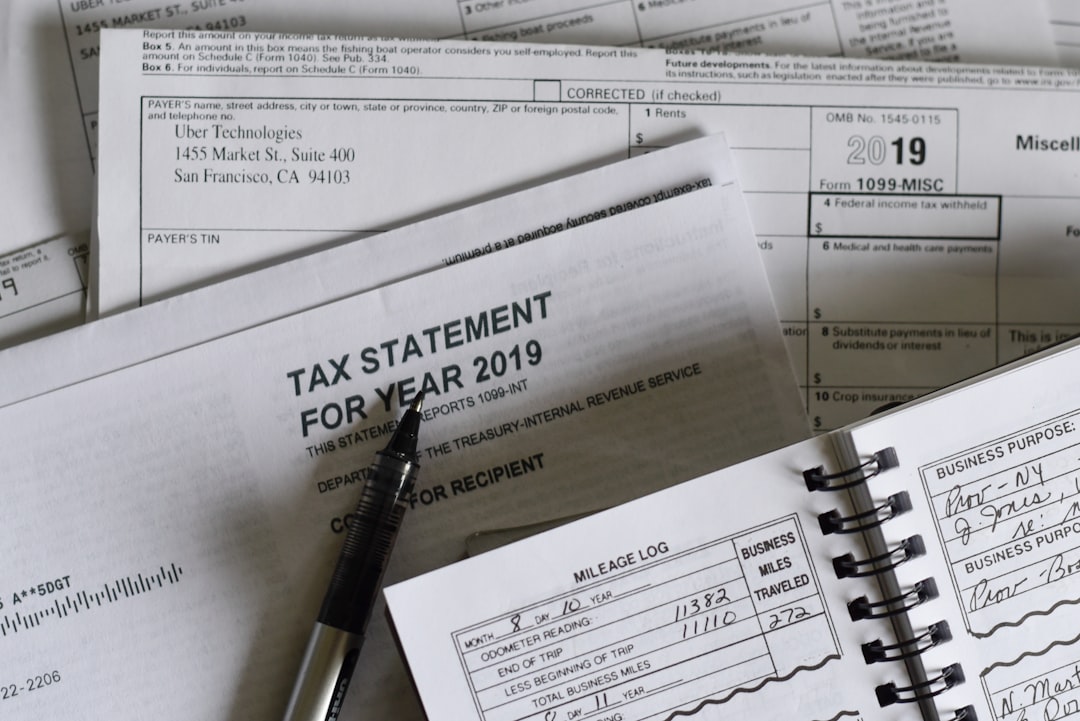

In the past, the paystubs were accompanied by the paychecks but with the eruption of the digital world, they are just digital documents in the business payroll software. the federals laws requires one to know when their employees have worked and the wages they’ve gotten for the same. in many states, preparations for the paystubs for the employees is mandatory and should be prepared. if you want to get a specific loan, then the paystub can be used effectively as a proof of being employed.

the other benefit with the pay stubs is they enable one to spot errors fast in their payment history so always view here on this. when preparing the paystub check, these are important details that needs to be included. in the paystub check, one need to gather details like the name and address of the employees plus their payment period. the benefit with this is it allows you to track down a specific paystub for a specific employees.

its viable to include their national security details and the identification numbers in the paystub so click for more about the same. on the pay period, this will include the week, monthly or the day when the employee is being paid. the other inclusion in the pay stub check is the hour the employees have worked for the business. the hours the employees have worked means more in the business and should be broken down based on these roles they’ve offered on different times so view here for more details.

its also peculiar to check on the gross pay plus the deductions made to clients so read more here. the money you receive from working for the business before any deduction and taxation are made is referred to as gross pay so view here! about this. the gross pay will indicate the commissions one have received, tips and other bonuses gathered for working in the business so read more here. on the deductions issues on the pay stub, it should reflect the insurance deductions, in terms of premiums, union dues deducted, all the taxes, retirement deductions and any other so click here for more.

In the pay stub also, the net pay matters and must be included and it shows the money the employee will get when the deductions are all expunged. its mandatory for the pay stub to be prepared by all businesses and so it should be prepared in an efficient manner and correctly. payroll software is necessary in some businesses for it enables them to prepare the pay stub effectively and fast.